CTAM, the Cable and Telecommunication Association for Marketing, held their 2024 Canada Broadcaster Forum this Wednesday in Toronto at Meridian Hall.

Education Co-chair Brad Danks, CEO of Outtv, invited me to moderate one of the panels. The theme of that panel was Adapting to the Future: Canadian Companies Meeting the Challenge,” which sounded optimistic to me. How is debt-ridden Corus Entertainment, I immediately thought, adapting to the future? And didn’t Rogers and Corus both announce more layoffs in their radio businesses just this week?

Yet here we were in 2024, with CTAM drawing the biggest turnout for its annual Canadian forum in years. In Canada, there seem to be more independent members representing media companies with not just linear channels but businesses and partnerships across streaming and other platforms. Chris Knight, President and CEO of Gustotv, told me he just closed a deal with Apple where homemakers can ask Siri for the latest carot cake recipie from Gusto. Tips on thinking outside the box never grows old.

Knight was part of the panel I moderated, where he was joined by David Purdy, Chief Revenue Officer of Stingray, a global music media and technology company; Drew Robinson, vice president, content distribution at Corus Media and Jamie Schouela, President, Global Channels and Media at Blue Ant Media.

The advice they all kept returning to in terms of adapting to the future was to be prepared to “pivot relentlessly.” Keynote speaker Alan Wolk from the media analyst website TVREV, made the same point with a slide he projected, quoting Charles Darwin saying, “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

The one pivoting the most at the session was probably Robinson, whose independent broadcast company, Corus Entertainment, is being shopped as a result of a billion dollar debt. Kudos to Robinson, a 20-year industry veteran, for remaining cheerful and focused on his job, which includes managing the remaining specialty assets under the Corus tent. The data he’s been keeping an eye on shows viewership remains strong for the brands such as HGTV which have been renamed “Home” at Corus in advance of Rogers’ takeover of the Discovery channels, which is scheduled to take place in Canada at the end of this year.

advertisement

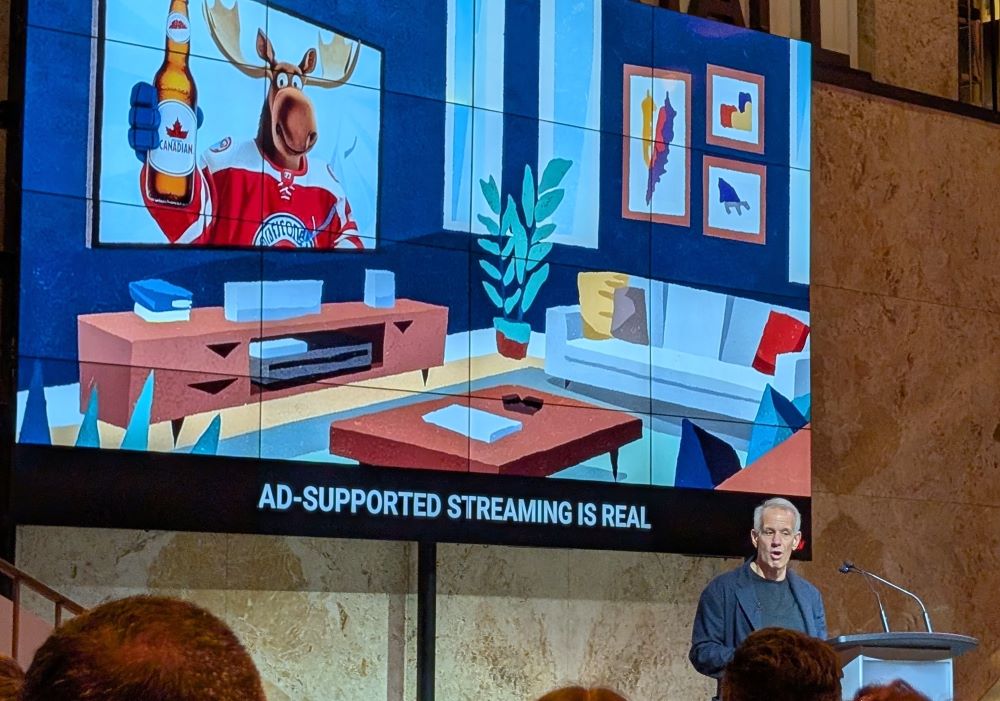

Wolk, known for coining phrases such as “FAST channels,” suggested “AI will change everything” in terms of advertising and consumer interactions. Things are going to start appearing on your television screens which will be curated towards your preferences. The long-promised app that will allow you to buy, say, shoes you see on The Bachelor, may finally be close to a reality. AI, he said, will also play a role in determining which shorter ads you will see on FAST channels. They’ll be fast, but they will also be targeted, making them a much more effective ad buy.

These kinds of targeted advertising potentials grabbed attention in a room where ad buys have not been what they used to be.

Another thing that stood out for me from Wolk’s presentation was the dominance of YouTube in the Canadian media landscape. For example: YouTube, at 59 per cent, outdraws Netflix (56%) and Amazon (45%) as the top site Canadian viewers choose to use to watch television online. From our panel, Schouela at Blue Ant and the others saw partnering with YouTube on channels and promotional shorts as an important gateway to cutting through the clutter.

Another thing Wolk singled out were Operating Systems or the TV screen itself. Do you watch TV on a Samsung? Tizen, the Korean company where Samsung is a top brand, is the world’s largest TV manufacturer and it has the biggest share of OS systems in Canada. Google, Roku, Fire TV, LG and Chromecast follow in order of preference.

Why this matters: if you are paused on a streaming menu, say on Disney+, Paramount+ or Prime Video, after a while, the screen shifts to a series of static images promoting various shows and movies. This is far from random. Many in the CTAM room pay to have their shinny new project placed before your eyes on this kind of carousel. Viewers click on the ad they are curious about and then head straight to that show. It is a powerful tool that the people I spoke with said is a very effective trigger.

A few other takeaways from the CTAM Forum:

Sixty per cent of Canadians are still traditional TV subscribers. Thirty-seven per cent say they have no plans to cut the cord. This doesn’t mean CBS or NBC will be around forever. At some point, Wolk figures, Paramount or Universal will figure there is little sense in making two different kinds of shows for two different platforms. Not next season, however; Wolk figures in five or ten years.

Canadians spend an average of 35.5 hours per week watching video content. Eight in 10 Canadians report subscribing to at least one OTT streaming service. One third of Canadians report using at least one FAST channel such as Tubi, Pluto and LG channels.

Wolk says the real competition is not other media companies. Canadians watch 16 hours of long-form video content a week on social media, with YouTube the most popular destination.

Piracy was one elephant in the room raised at our session. Robinson from Corus says one solution seems to be offering programs on more than one platform, including one that is very affordable. Sit through fewer ads and stream Survivor on-line on STACKTV, for example. Your signal won’t get taken down in the middle of an episode and watching it legally won’t get you kicked off the island.

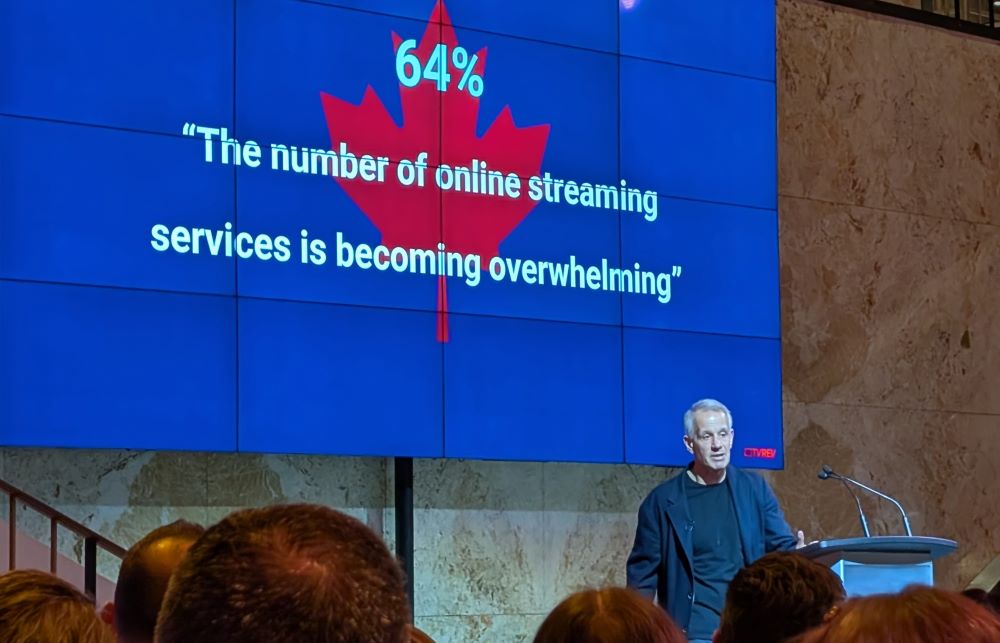

Finally, yes, 64 per cent of Canadians agree that “the number of online streaming services is becoming overwhelming.” And that will eventually lead, Wolks says, to more bundling. Disney’s move to put Hulu and ESPN into one big basket for consumers seems to be countering the trend to opt out and create churn. Whoever figures out how to put your five favourite streaming shows in one destination — instead of five different platforms you need to subscribe to — will ultimately deliver what consumers really want and, most importantly, can afford.